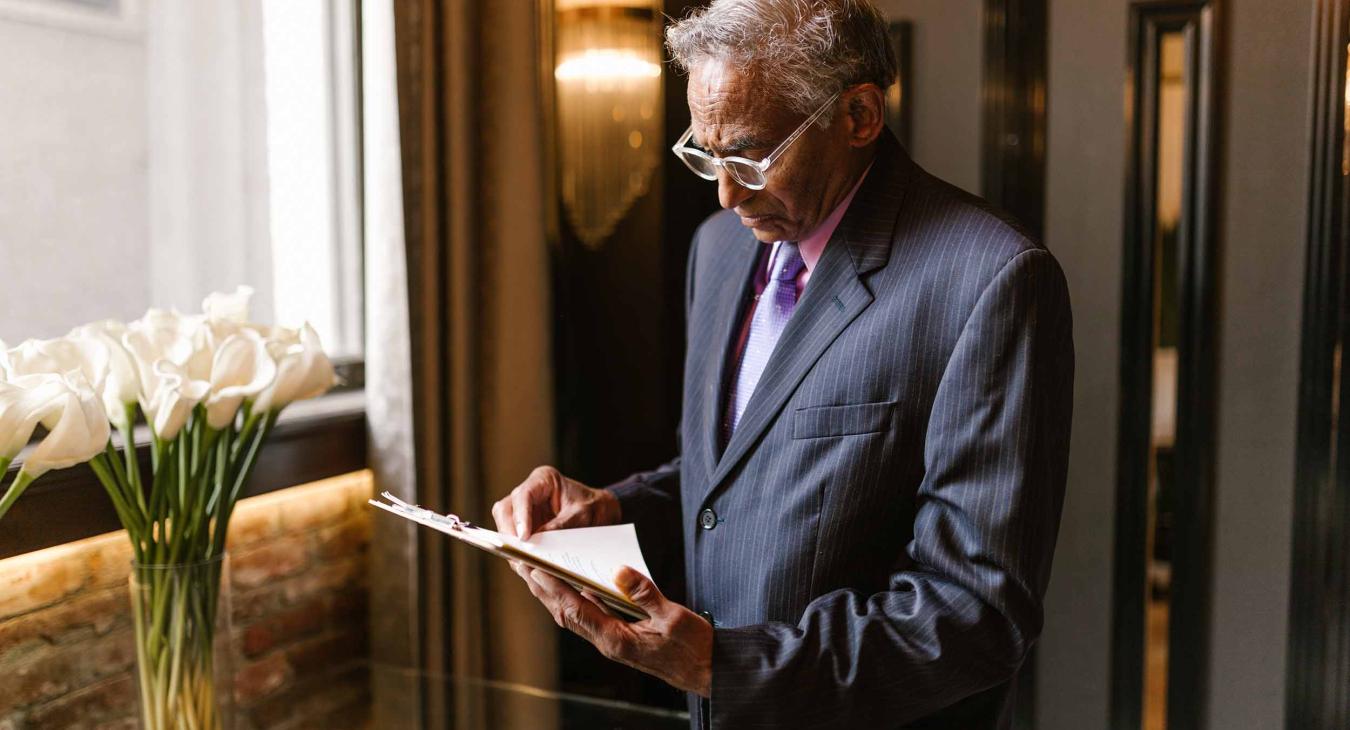

We have gone to Rogoff for many years for tax advice, preparation, and estate planning.

Our firm's Tax Department offers full services to corporations, partnerships, individuals, estates, trusts and tax-exempt organizations. The services include both compliance and planning.

Tax Planning

Planning for a business begins well before the business is actually started. Numerous decisions must be made, such as: Should the business be incorporated or organized as a partnership or sole proprietorship? What accounting methods for financial reporting and tax purposes should be elected? How should compensation levels and methods be structured? What credit facilities will the business need? What is the most advantageous accounting period?

Once the business has started operations, timely tax planning should be a high priority of management.

Compliance

Tax Department professionals are responsible for the preparation and/or review of all tax returns and the representation of clients at tax examinations. They also communicate with clients and meet with all Partners and professional staff to keep them abreast of new tax laws and regulations.

Our firm's Tax Department offers full services to corporations, partnerships, individuals, estates, trusts and tax-exempt organizations. The services include both compliance and planning.